Fertilizer Innovation in Nebraska: Start-up to Scale-up

- The Combine

- Sep 20, 2022

- 4 min read

This Insights Report was created as part of the CRU Fertilizer Agritech Forum presentation from The Combine

Global Pressure around Fertilizer Prices

Throughout the past year much focus has been placed on fertilizer and its respective prices. Reduced shipments from Russia and Belarus, which account for nearly 25 percent of global fertilizer exports, have made a market that was tight at the outset of the fighting even tighter. The price of granular urea and the most widely traded fertilizer on global markets, jumped more than 70 percent in the first six weeks of the war.

Global fertilizer consumption has remained strong throughout the COVID-19 pandemic. Brazil and the United States have allocated record acreage to soybean (a fertilizer-intensive crop). Demand is also strong in China due to increased feed use, especially maize and soybean meal, as the country is rebuilding its hog herd population following the African swine fever outbreak. Fertilizers are now at their least affordable levels since the 2008 global food crisis, despite higher crop prices, which may limit fertilizer us (Source: World Bank).

The Fertilizer Industry in Nebraska

Fertilizer adds minerals to the soil, making farms healthier and more productive. Often, fertilizer can make the difference between a disappointing harvest and a profitable one.

It’s estimated that nitrogen fertilizer now supports approximately half of the global population. In other words, Fritz Haber and Carl Bosch — the pioneers of this technological breakthrough — are estimated to have enabled the lives of several billion people.

Nebraska Innovation in Fertilizer

As a leader in large-scale production agriculture, Nebraska entrepreneurs have a unique opportunity to both create and bring to broad market adoption innovations in fertilizer, ag inputs and soil health.

One local example is Sentinel Fertigation.

Sentinel provides a sensor-based, data-driven model for predicting and prescribing nitrogen fertilizer applications, with the goal of increasing the overall efficiency per lb/acre of applied fertilizer.

The technology is being commercialized following a 2 year study at the University of Nebraska-Lincoln. In one sample plot, Sentinel’s approach to nitrogen management allowed for a 20% reduction in applied nitrogen, while producing a similar yield to current best practices.

In addition to the economic benefits for farmers, there are environmental benefits to using less nitrogen fertilizer. Nitrates not taken up by crops are not adsorbed to soil materials, that is, they do not necessarily remain in the place they were applied until next season. Nitrogen runoff from poorly managed fields contaminates nearby bodies of water, causing algal blooms, ammonia spikes, and the death of aquatic.

“Sentinel Fertigation provides a win-win solution that ultimately allows farmers to increase their yield per unit of applied nitrogen and enhance their environmental sustainability,” said CEO Jackson Stansell. “I am grateful for each of our investors and their support in our efforts to bring N-Time™ FMS to farmers and their trusted advisors. Our paid pilot program this season is the first step to our system making a significant impact at scale. I am excited about the team we have begun assembling and working with them to make Sentinel the leader in fertigation management.”

One example of a later stage company in Nebraska impacting clean chemical production is Monolith Materials.

Monolith’s carbon black enables manufacturers such as Goodyear to meet sustainability goals and demand for clean materials. Carbon black is an essential material found in countless everyday products, but perhaps most notably in tires. Conventional carbon black is produced by burning decant oil or coal tar, releasing large amounts of greenhouse gases into the atmosphere. Monolith, through its proprietary pyrolysis process, has developed and perfected a new technology that uses renewable electricity to convert natural gas into high-purity carbon black and hydrogen. (source GreenCarCongress Report)

The company recently announced it plans to use its proprietary process to produce approximately 300,000 metric tons per year of carbon-free anhydrous ammonia in the United States. Current ammonia production practices account for approximately 1 percent of total global greenhouse gas emissions, or roughly the equivalent of the total emissions of the United Kingdom.

Anhydrous ammonia, the building block for essentially all nitrogen fertilizer, is used by a wide variety of industries. Eighty percent of ammonia produced is utilized by the agriculture industry in fertilizer to help sustain food production for billions of people around the world. In the United States, the "Corn Belt", stretching from Iowa, Illinois, Indiana, Nebraska and neighboring states, imports over 1.7 million metric tons of ammonia. Monolith is focused on providing locally sourced, clean anhydrous ammonia (source Monolith Press Release).

The Opportunity for Tomorrow Entrepreneurs

The next generation of entrepreneurs across the country will be backed by two critical tailwinds:

1) The increase in capital deployed from private markets related to fertilizer technology

2) New nutrient management and regenerative agriculture programs from the federal government.

Collectively, over $4B has been raised in venture capital by early stage technology companies related to fertilizer.

The seventeen Series C+ deals in the space accounted for over $2B in private capital invested.

115 companies innovating in the fertilizer space raised capital at a pre-seed stage via an accelerator or early stage incubator.

The geographic breakdown of venture funding in fertilizer technology generally follows most other sectors: North American headquartered startups raised over $2.6B via 220 deals followed by European and Asian companies.

Collectively these 500+ deals in the past five years can be broken into four general buckets:

Innovations in biology and chemistry related to fertilizer technology have accounted for the majority of the venture capital in the space.

As mentioned, the other key tailwind supporting entrepreneurs nationally in fertilizer technology is the increase in federal resources.

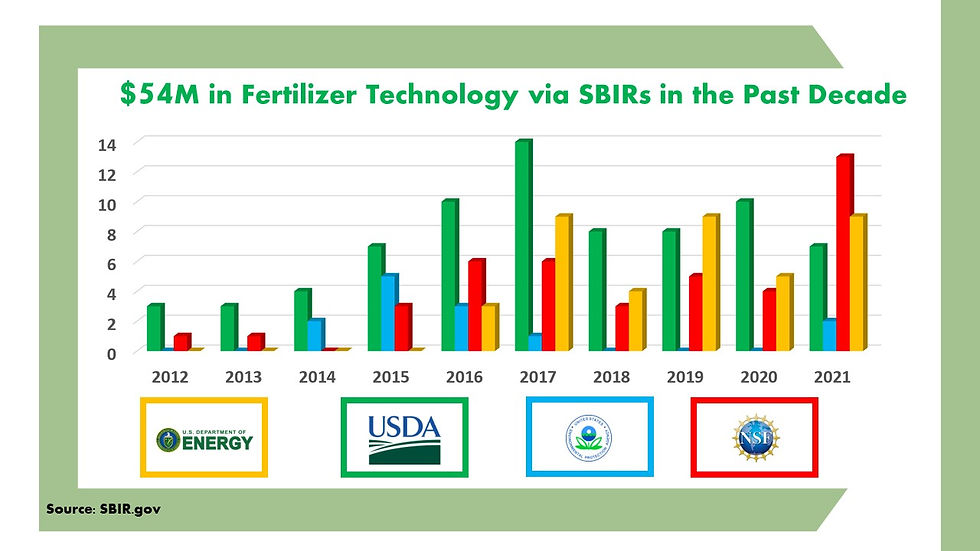

The Small Business Innovation Research (SBIR) Program is a highly competitive three-phase award system which provides qualified small business concerns with opportunities to propose innovative ideas that meet the specific research and research and development needs of the federal Government.

Historically the USDA has been the most frequent funder of early stage projected related to fertilizer technology. However, it is interesting to note that in recent years both the National Science Foundation and the Department of Energy have became frequent funders of the topic area.

On a cumulative dollar basis the Department of Energy is the leading SBIR funder of fertilizer related research and technology followed by the USDA.

These tailwinds in both public and private funding for technologies related to fertilizer innovation demonstrate the case for a strong coming decade for both entrepreneurs in soil health both in Nebraska and across the country.

Comments